The Solana Legend Series: Blue Oceans & The Future Of Web3 In Asia

Solana Legend goes deep on the future of crypto culture, the recipe for building a rockstar web3 team, tech debt as it relates to the blockchain and blue ocean opportunities in Asia.

I sat down with Solana Legend (a.k.a. Diego) late on a Friday night as he started his weekend work day in Tokyo. We opined about the future of crypto culture, building rock star web3 teams, tech debt and the blue ocean opportunity in Asia.

This is the first installment of the Solana Legend interview series, next week we dive into “the man behind the PFP.”

Subscribe to the Mad News today so you don’t miss the next issue!

Where do you think the future of web3 is heading? Where should students be focusing their efforts?

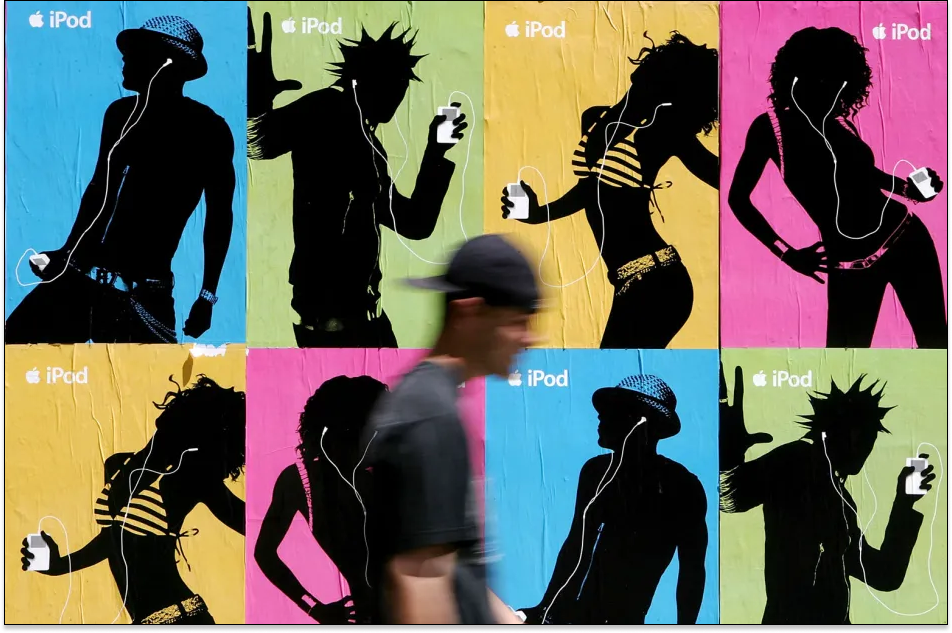

Legend: I think there's gonna be a big officialization of the space. I think crypto companies are just gonna become tech, and digital assets will kind of just be assets. You know, in a similar way that music was initially called music files, then were called MP3 files, then they dropped MP3 and it was just music.

Legend: I think that’s the direction we're heading where there’s gonna be better crypto applications that seamlessly allow people to interact with the blockchains without even realizing it.

There's also gonna be much more acceptance around digital assets as an asset class.

I think that's an area where if you're an investor or someone who's interested in being a developer or working with startups, either, you know, directly or investing in them. This is gonna be a super, super promising field in my opinion.

Legend: And for many younger graduates, what I would say is just kind of look around you and look at your generation, right?

Legend: People are “terminally online” as my friend Ansem says. They've grown up on the internet with a smartphone from their first memory basically and they hang out, you know what I mean?

There's gonna be autonomous agents too that basically raise kids, you know, those human to machine interactions I think are gonna be very, very widespread.

Legend: At the point when they hang out in digital communities, they spend their time and their money in digital communities on digital assets and on big platforms like TikTok.

This is the direction that irreversibly my generation and younger generations have taken, and I think staying close to crypto in general in this environment is a very good idea.

You’re involved with all these a-list teams who are building really cool products. What kind of pain points are you seeing these builders run into?

Legend: Honestly, the way I'd answer it is every team needs essentially three people, three types of people.

The first of which is a technical founder with a strong background in product and engineering that can articulate a vision of what they want to build and have that kind of line up with a real life problem.

And I see a real life problem because there's a lot of crypto founders that are solving problems that are not actually problems.

They're kind of creating a problem and then solving it, or creating a robotic horse when cars exist.

It's kind of like a web three version of a web two platform that's just like worse in almost every sense.

Legend: The second person you need is a very strong business person with a background in finance or accounting.

Someone that's able to operationalize and keep the house in order and excel a kind of a project manager. They can raise, they can balance a budget.

They can make sure that while the hard engineering problems are getting solved that the house is not burning and that everything's in order from a legal perspective, accounting and controls.

Legend: And the third person that they need is a crypto native comms person.

A social media lead that is taking all the information from the product and the business side and developing an engaging Twitter presence and Twitter persona that is able to garner the interests of the users - which currently are all on X.com

What do you think is the best place for a crypto and blockchain native company to start building?

Legend: I think there's a number of geographies that are attractive. I think some of them for different reasons. A lot of the user base for these crypto applications and especially a lot of the population of traders is in Asia.

That's where 70-80% plus of crypto trading volumes come from.

Legend: It's very surprising to people in the in the US. There's a very big Western bias which is well documented throughout stocks and just everything.

People in the US tend to just kind of view that as a center in the beginning of the end of the world.

But when it comes to emergent tech, like crypto, you have to consider the leapfrog effects of economies that are not as developed as the US.

Legend: What I mean by that is in the same way that the US went from dial-up to broadband and then fiber optic. Every time there's a jump in technology they keep having to revisit it and it's almost like tech debt, right?

If you have established broadband all over the country and now fiber optic is the prevalent technology, you need to basically lay all that cable again.

There's a big cost and lag in adoption lag and doing that. Tech debt.

Legend: Whereas if you're in Vietnam and smartphones just came out when people didn't even have broadband. It turns out the rates are much higher because they jump directly to 4G, 5G and Starlink and fiber optics directly.

And there's a very, very powerful effect, the leap effect that I'm referring to. But also around crypto adoption as well, because the US has a very strong financial and capital markets infrastructure.

The problem is that it's also very regulated and it's very hard for new entrants and new technologies to make inroads in that environment.

Good luck digging out JP Morgan or Visa or American Express in their business that they've held for, you know, decades or even a century. It’s just not gonna happen.

They're too connected politically and there's too much red tape preventing you from just disrupting it.

But if you go to an economy like Vietnam or even in Africa as a more clear example, it's just blue water, there's no good financial infrastructure. So you can just go out there and add users.

Who are we not thinking about when considering the next billion users?

Legend: I mean, the first obvious group is people who rely on payments in their day to day life, for example, they work overseas and they send payments or Remittance to his home back to their home country.

Any business where countries, for example, like Nigeria or Philippines where actually a large portion of national income comes from service workers abroad or folks that are sending money back home to their families.

Any business that's pretty financial - where there's a lot of transactions or, micro transactions, or a large volume of payments - that you're currently routing through traditional rails.

Legend: I'd say as soon as they've experienced crypto and they see how seamless and fast and instant it is, they'll realize that the 24/7 crypto rails are just literally 10x or 100x better than that traditional banking world that we're used to.

Where you get charged $20 bucks for a wire and if you send it on a Friday, it doesn't arrive ‘till a Wednesday and that sort of thing. It's just very, very cumbersome.

So I'd say anything where people are doing a large amount of transactions that are repetitive. And that includes gamers, I think gaming and crypto go hand in hand in a major way.

Already you've seen this in different pockets of people, right, in the betting community, you've seen it. A lot of high stakes poker players were very early to crypto for this reason.

Legend: I think just more generally, people that are digitally native and interacting in these sort of communities are very, you know, liable to have an overlap with NFTS and crypto.